Social Impact of the US-Indonesia Trade Agreement on Indonesian Rural Communities

Social Impact of the US-Indonesia Trade Agreement on Indonesian Rural Communities

Zainul Abidin

Research Assosiate The Reform Initiatives

Introduction

Overview of the US-Indonesia Trade Agreement: Announced Terms and Context

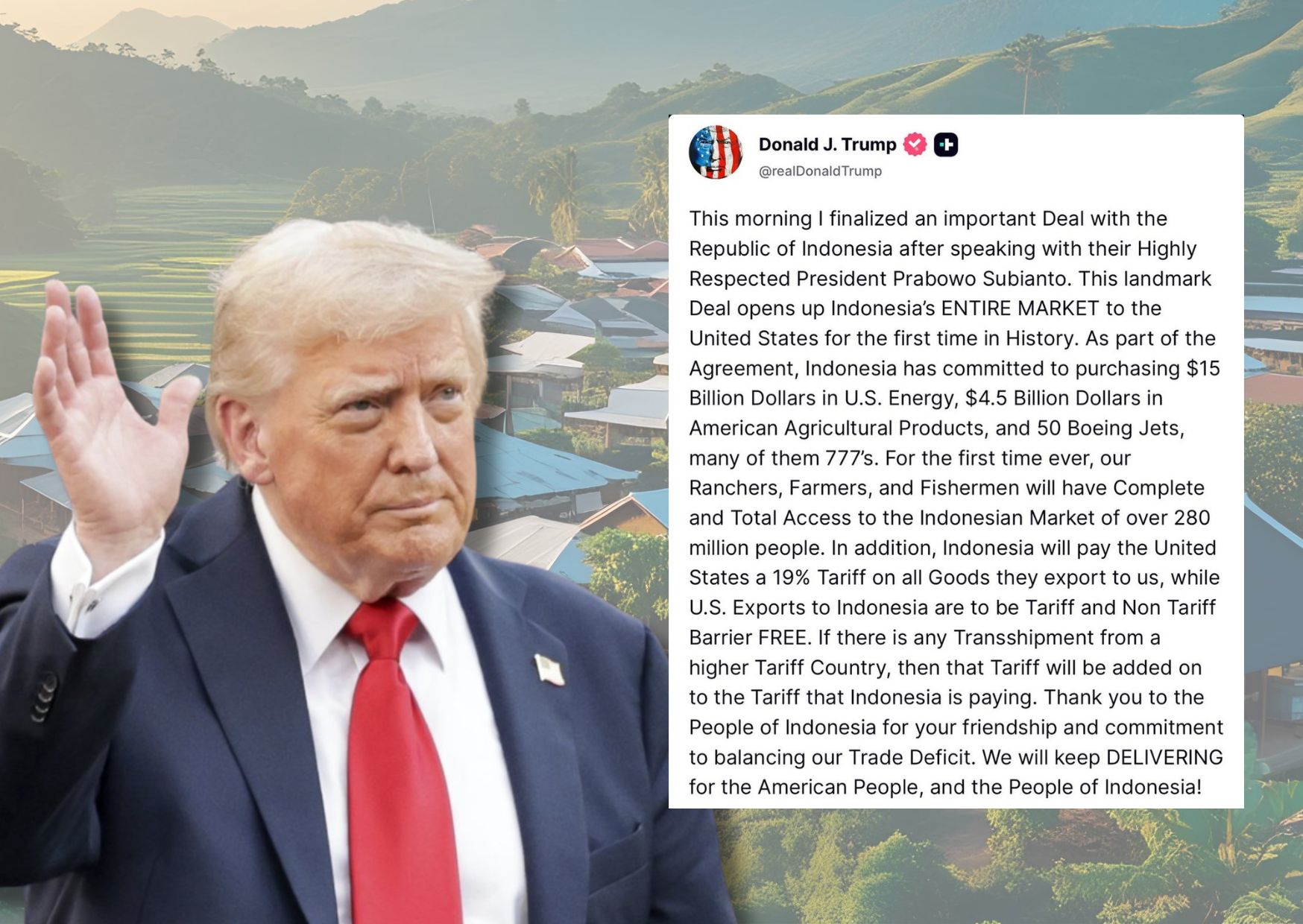

On July 15, 2025, US President Donald Trump announced a major trade agreement with Indonesia via the Truth Social platform. In his statement, Trump claimed that he had finalized a significant deal with President Prabowo Subianto, whom he referred to as a “Highly Respected President”. This agreement, according to Trump, would “open up Indonesia’s ENTIRE MARKET to the United States for the first time in History,” providing full access for American ranchers, farmers, and fishermen to Indonesia’s market of over 280 million people without tariffs and non-tariff barriers.

As part of the announced agreement, Indonesia will purchase $15 billion worth of energy products from the US (approximately Rp243 trillion) and $4.5 billion worth of US agricultural products (approximately Rp72 trillion). Additionally, Indonesia committed to purchasing 50 Boeing aircraft, including many 777 types. Conversely, goods exported from Indonesia to the US will be subject to a 19% tariff, down from a previous threatened tariff of 32%. Trump also warned that additional tariffs would be imposed if transshipment or diversion of export routes from higher-tariff countries occurred through Indonesia.

This agreement was announced ahead of an August 1 deadline for higher import tariffs by the US and is similar to deals recently reached with Vietnam and the UK. Total bilateral trade between the US and Indonesia amounted to approximately $40 billion in 2024, with the US recording an $18 billion goods trade deficit with Indonesia in the same year.

The structure of this agreement reveals a fundamental imbalance. The “tariff and non-tariff-free” market access granted to US exports to Indonesia contrasts sharply with the 19% tariff imposed on Indonesian exports to the US. Although this 19% tariff is a reduction from the previous 32% threat , it is still significantly higher than Indonesia’s average Most Favored Nation (MFN) tariff of approximately 8% in 2023 8 and the baseline 10% tariff in effect since April. This imbalance potentially provides a disproportionate advantage to US exporters, while simultaneously increasing cost burdens for Indonesian exporters, which could affect the profitability and economic stability of Indonesia’s export-oriented sectors.

US-Announced Provisions: Market Access, Purchase Commitments, and Tariffs on Indonesian Exports

The trade agreement between the US and Indonesia, as announced by President Donald Trump, sets several key provisions that will shape the bilateral trade landscape. These provisions reflect the US priority of reducing its trade deficit and opening new markets for its products.

Specifically, the agreement includes Indonesia’s commitment to make substantial purchases from the US, totaling $15 billion for energy products and $4.5 billion for agricultural products. Additionally, Indonesia will purchase 50 Boeing aircraft, including many 777 models. In return, the US will gain full access to the Indonesian market for its products, meaning US exports to Indonesia will be free of tariffs and non-tariff barriers.

On the other hand, products exported from Indonesia to the US will be subject to a 19% tariff. This tariff is a reduction from the initial 32% tariff threat previously made by Trump. The agreement also includes a transshipment clause, stating that if there is a diversion of exports from a higher-tariff country through Indonesia, additional tariffs will still be imposed.

The following table summarizes the key provisions announced by the US:

Table 1: Key Provisions of the US-Indonesia Trade Agreement (as announced by the US)

| Type of Provision | Detail |

| US Market Access to Indonesia | Full and unprecedented access for US products (energy, agriculture, Boeing aircraft), free of tariffs and non-tariff barriers. |

| Indonesia’s Purchase Commitments | $15 billion in US energy products, $4.5 billion in US agricultural products, 50 Boeing aircraft. |

| Tariffs on Indonesian Exports to US | 19% tariff on all goods exported to the US (down from a threatened 32%). |

| Transshipment Clause | Additional tariffs will be imposed if transshipment occurs from a higher-tariff country through Indonesia. |

Table 2: Comparison of US Tariffs on Indonesian Exports vs. Other ASEAN Countries (as per Trump’s announcement)

| Country | US Tariff on Exports (%) |

| Indonesia | 19% |

| Laos | 40% |

| Malaysia | 25% |

| Myanmar | 40% |

| Cambodia | 36% |

| Thailand | 36% |

| Philippines | 20% |

| Brunei Darussalam | 25% |

This table shows that while the 19% tariff is lower than the previous 32% threat, and lower than some ASEAN countries like Laos or Myanmar, it is still higher than the Philippines and could affect Indonesia’s competitiveness in the US market, especially when compared to countries with lower or no tariffs for certain commodities. This highlights that the “good deal” narrative from the US side needs to be scrutinized further from the perspective of Indonesia’s export competitiveness.

Broader Socio-Economic Impacts

A. Food Security Concerns and National Food Sovereignty

Indonesia’s commitment to purchase $4.5 billion worth of US agricultural products and grant full market access for US agricultural products directly impacts its food security landscape. Increased reliance on imports can weaken the local agricultural sector and threaten national food sovereignty. This is particularly relevant given Indonesia’s goal to achieve food self-sufficiency by 2028 and its plan to halt imports of key commodities such as rice, corn, sugar, and salt by 2025.

The government has allocated a substantial budget (Rp139.4 trillion for 2025) for food security, focusing on increasing productivity, improving infrastructure, and empowering small farmers. However, critics express pessimism about achieving self-sufficiency without clear and comprehensive strategies beyond mechanization and subsidies.

This agreement creates a fundamental policy conflict between trade liberalization and national food self-sufficiency goals. The core of the US-Indonesia trade agreement, as announced, promotes extensive market liberalization for US agricultural products into Indonesia. This directly contradicts Indonesia’s stated national policy goals of achieving food self-sufficiency by 2028 and halting imports of critical food commodities by 2025. Increased tariff-free US agricultural imports could flood the domestic market, depress local prices, and reduce incentives for domestic production, thereby undermining the food sovereignty and farmer empowerment goals the government aims to achieve through significant budget allocation. This fundamental policy conflict poses a significant challenge. If the trade agreement is implemented as announced, it could seriously jeopardize Indonesia’s food sovereignty agenda, increase its reliance on foreign food sources, and potentially lead to long-term vulnerabilities in its food supply. The social impact will be directly felt by small farmers, whose livelihoods are tied to domestic food production, and indirectly by consumers, if import dependence leads to price volatility or supply chain disruptions.

B. Land Use Dynamics and Agrarian Reform Progress

Indonesia faces significant challenges related to land ownership inequality, land grabbing, and agrarian conflicts, with a large portion of land controlled by a small segment of the population. Many small farmers own increasingly shrinking plots of land. The government’s agrarian reform aims to alleviate poverty and achieve food self-sufficiency through land redistribution to small farmers. However, implementation has been slow, and there is a push for large-scale, corporate-managed food estate projects, which critics argue displace local farmers and prioritize corporate interests. Urbanization and other factors have led to a 20% national decrease in total rice harvest area between 2010 and 2020.

This trade agreement could indirectly put pressure on land resources and exacerbate agrarian conflicts. If the influx of cheaper US agricultural imports makes small-scale farming less profitable, it could accelerate the abandonment or sale of agricultural land by struggling farmers. This would worsen existing problems of land ownership inequality and shrinking farmer landholdings. Furthermore, to compensate for potential declines in domestic food production due to imports, the government might intensify its push for large-scale, corporate-led food estate projects. However, these projects are often associated with land grabbing, displacement of local communities, and environmental damage. The trade agreement, by potentially undermining the economic viability of small-scale agriculture, could indirectly intensify pressure on land resources, leading to increased land conversion, higher agrarian conflicts, and a reversal of progress in agrarian reform. This would have severe social consequences, including displacement, loss of traditional livelihoods, and increased vulnerability for rural communities.

C. Exacerbation or Mitigation of Regional Disparities and Rural Poverty

Trade liberalization, while aiming for overall economic growth, can lead to uneven impacts at the sectoral economic level, household income distribution, and regional development. LPEM UI research indicates that price differences for staple foods across regions are widening and challenges in effectively distributing benefits or mitigating negative impacts in the most disadvantaged rural areas, leading to potential new disparities. A survey of experts also shows that inclusivity in Indonesia is still “not good” and inequality has “not reached its target,” which increases the risk of social instability and reduces the welfare of vulnerable groups. Case studies on rural development underscore that capital interventions can lead to divergent development outcomes and may create social conflicts if not managed with significant participation from villagers.

This trade agreement risks widening socio-economic gaps and fueling social unrest. If the benefits of the trade agreement primarily flow to large-scale industries or urban centers (e.g., energy, aviation sectors) while rural agriculture and MSME sectors face significant competitive pressure and decline, it will inevitably exacerbate existing regional disparities and rural-urban income gaps. The challenges in ensuring equitable distribution of government programs like Village Funds in the most disadvantaged villages further compound this risk. Historical precedents from NAFTA and India demonstrate how trade agreements, if not managed with strong social safety nets and inclusive policies, can lead to widespread social discontent, increased poverty, and even mass migration. The social impact of this trade agreement is not merely economic but profoundly social and political. A perceived lack of fairness or disproportionate negative impacts on rural communities could erode trust in the government, fuel social unrest, and undermine efforts towards national unity and equitable development, potentially leading to long-term social instability.

Mitigation Strategies and Indonesian Government Policy Response

A. Existing Policies and Programs for Farmer Protection and Empowerment

The Indonesian government has explicit policies and programs aimed at protecting and empowering small farmers. These include regulating import entry points for agricultural commodities and general laws for farmer protection and empowerment. The government has a strong commitment to food sovereignty, with President Prabowo targeting self-sufficiency by 2028 and plans to halt imports of four key commodities (rice, corn, sugar, salt) by 2025.

A substantial budget of Rp139.4 trillion is allocated for food security in 2025, focusing on increasing agricultural productivity through mechanization and digitalization, developing superior seeds, promoting environmentally friendly fertilizers, strengthening irrigation and infrastructure, and empowering small farmers through improved access to finance, training, and cooperatives. There are also calls from the House of Representatives (DPR) to limit import quotas to protect MSMEs, recognizing their significant role in absorbing 90% of the workforce.

However, a policy paradox exists between domestic ambitions and international commitments. The Indonesian government has formulated clear and ambitious domestic policies aimed at protecting small farmers, achieving food sovereignty, and reducing import dependence. These policies are designed to strengthen the rural agricultural sector. However, the US-announced trade agreement directly contradicts the spirit, and potentially, the substance of these domestic policies by demanding full and tariff-free market access for US agricultural products. This creates a significant policy paradox where the government’s international trade commitments appear to undermine its national development goals for rural communities. The effectiveness of existing and planned farmer protection programs will be severely challenged by the new trade requirements. Without a clear strategy to reconcile these conflicting objectives, the government risks failing to achieve its food sovereignty goals and could inadvertently exacerbate the vulnerability of its rural agricultural population, leading to social and economic impacts.

B. Diversification of Trade Partners and Strengthening Domestic Economic Resilience

Indonesia has actively pursued trade agreements with other partners, such as the Indonesia-EU CEPA, which provides market access to 27 European Union member states. Experts and government officials emphasize the need to expand non-US markets for Indonesian products, especially for fishery products, with potential in European and Chinese markets.

Indonesia has the flexibility to diversify its markets, as exports to the US account for less than 10% of its total shipments. Possible strategies include proactive bilateral negotiations, leveraging Generalized System of Preferences (GSP) status, reassessing non-tariff measures, attracting Foreign Direct Investment (FDI) into intermediate goods manufacturing, and strengthening anti-dumping measures. Economic think tanks like INDEF emphasize the importance of strengthening domestic economic resilience through adaptive policies in the trade, industry, energy, food, fiscal, and monetary sectors. They also warn of the risk of China diverting surplus goods to Indonesia, potentially weakening the domestic market.

The urgency for proactive and targeted diversification is increasing. While Indonesia has stated policies for market diversification and strengthening domestic resilience, the specific provisions of the US agreement (full market access for US goods, 19% tariff on Indonesian exports) elevate this from a general strategy to an urgent necessity. This agreement could significantly reduce demand for Indonesian exports in a key market (the US) and intensify competition in the domestic market from US imports and potentially diverted Chinese goods. This demands a more aggressive and targeted approach to market diversification and domestic strengthening than previously envisioned. The success of Indonesian rural communities in navigating the challenges of this trade agreement will heavily depend on the government’s ability to quickly and effectively open and secure new export markets, while simultaneously strengthening domestic demand and protecting local industries from unfair competition. Failure to do so could lead to significant economic contraction in affected rural sectors.

Policy Recommendations

A. Strengthening Local Agricultural Resilience and Food Sovereignty

The government needs to implement robust domestic policies to enhance the competitiveness and sustainability of smallholder agriculture in Indonesia.

- Targeted Subsidies and Support: Increase and optimize subsidies for quality seeds, environmentally friendly fertilizers, and modern agricultural equipment to boost productivity and reduce production costs for small farmers.

- Infrastructure Development: Accelerate investment in critical rural infrastructure, including irrigation systems, rural roads, and post-harvest storage facilities, to improve efficiency and reduce losses.

- Farmer Empowerment: Strengthen farmer cooperatives and farmer groups to enhance their bargaining power in the market, ensuring fairer prices for their produce.

- Accelerate Agrarian Reform: Expedite land redistribution programs and strengthen land rights for small farmers to ensure their access to productive land, rather than prioritizing large-scale corporate-managed food estate projects that could displace them.

- Research and Development: Invest in agricultural research and development to develop climate-resilient crops and sustainable farming practices that can withstand global competition.

B. Ensuring Equitable Distribution of Trade Benefits and Protecting Vulnerable Groups

The government needs to develop and strengthen social safety nets and targeted interventions to mitigate negative social impacts and ensure that trade benefits are distributed inclusively.

- Social Safety Nets: Establish and expand social protection programs for farmers and workers displaced by increased import competition or declining export demand, including unemployment benefits or temporary income support.

- Retraining and Upskilling Programs: Implement vocational training and upskilling programs to help affected rural populations transition to alternative livelihoods or more competitive sectors.

- Monitoring and Evaluation: Establish robust monitoring mechanisms to track the social impacts of the trade agreement at regional and household levels, with a specific focus on poverty rates, income disparities, and employment in rural areas.

- Community Participation: Ensure meaningful participation of rural communities and local stakeholders in the design and implementation of mitigation and development programs.

C. Proactive Diplomatic Engagement and Export Market Diversification

Pursue a multi-pronged diplomatic and trade strategy to clarify the US agreement’s terms, diversify export destinations, and strengthen Indonesia’s position in the global trading system.

- Clarify Agreement Terms with US: Continue detailed negotiations with the US to seek a more balanced and mutually beneficial agreement, especially regarding the 19% tariff on Indonesian exports and the scope of “full market access” for US products.

- Aggressive Market Diversification: Intensify efforts to secure and expand market access in non-US countries, particularly the EU, China, the Middle East, and Africa, for Indonesia’s key export commodities.

- Strengthen Trade Defenses: Enhance anti-dumping measures and enforcement against illegal transshipment to protect domestic industries from unfair competition and market distortions.

- Value-Added Exports: Shift focus from raw commodity exports to higher value-added processed goods to capture more value in global supply chains and enhance competitiveness.

Reference:

- Donald Trump announces new deal! Indonesia faces reduced 19% tariff rate; to buy $15 billion in US energy, 50 Boeing jets & more, diakses Juli 16, 2025, https://timesofindia.indiatimes.com/business/international-business/donald-trump-announces-new-deal-indonesia-faces-reduced-19-tariff-rate-to-buy-15-billion-in-us-energy-50-boeing-jets-more/articleshow/122528894.cms

- Indonesia to Pay 19% US Tariffs in Exchange for Full Market Access …, diakses Juli 16, 2025, https://jakartaglobe.id/news/indonesia-to-pay-19-us-tariffs-in-exchange-for-full-market-access-boeing-jets

- Navigating the US-Indonesia Trade Deal: Sector-Specific Opportunities and Risks in Global Supply Chains – AInvest, diakses Juli 16, 2025, https://www.ainvest.com/news/navigating-indonesia-trade-deal-sector-specific-opportunities-risks-global-supply-chains-2507/

- Dampak Kebijakan Impor terhadap Ketahanan Pangan di Indonesia – DJPb, diakses Juli 16, 2025, https://djpb.kemenkeu.go.id/kppn/watampone/id/data-publikasi/berita-terbaru/3689-dampak-kebijakan-impor-terhadap-ketahanan-pangan-di-indonesia.html

- Dampak Maraknya Impor Beras di Indonesia dalam 5 Tahun Terakhir terhadap Kesejahteraan Petani Padi, diakses Juli 16, 2025, https://ojs.unik-kediri.ac.id/index.php/jintan/article/download/5312/3378/19027

- 10 Famous Export Commodities from Indonesia, diakses Juli 16, 2025, https://ska-indonesia.com/10-famous-export-commodities-from-indonesia/

- Analisis Survei Ahli Ekonomi LPEM FEB UI Semester I 2025 Terkait 100 Hari Pertama Pemerintahan – MAKPI, diakses Juli 16, 2025, https://makpi.or.id/2025/03/16/analisis-survei-ahli-ekonomi-lpem-feb-ui-semester-i-2025-terkait-100-hari-pertama-pemerintahan/

- Catatan Akhir Tahun WALHI Sulawesi Selatan 2024, diakses Juli 16, 2025, https://walhisulsel.or.id/wp-content/uploads/2024/12/Laporan-Catatan-Akhir-Tahun-WALHI-SS-2024.pdf

- Perang Dagang dan Guncangan Pasar Keuangan – INDEF, diakses Juli 16, 2025, https://indef.or.id/perang-dagang-dan-guncangan-pasar-keuangan/

- Masa Depan Ekonomi Indonesia di Tengah Perang Dagang dan Konflik Timur Tengah – INDEF, diakses Juli 16, 2025, https://indef.or.id/publikasi/ktt-indef-2025/

Rctiplus.com

Rctiplus.com pewartanusantara.com

pewartanusantara.com Jobnas.com

Jobnas.com Serikatnews.com

Serikatnews.com Serdadu.id

Serdadu.id Beritautama.co

Beritautama.co kalbarsatu.id

kalbarsatu.id surau.co

surau.co